By Martin de Bruyn, CFA, CFP

In May I attended the Morningstar US investment conference in Chicago, Illinois, and visited Morningstar’s head office in downtown Chicago. Before Chicago, I spent three days in New York just to get a taste of The Big Apple, huge pastrami sandwiches, Wall Street, and lots of other interesting sights.

Morningstar is a financial services and technology business with about 10,000 employees, has a presence in 28 countries, and manages/advise on about $263bn in assets. We deal mainly with the discretionary fund management (DFM) division that researches fund managers and manages risk profiled portfolios and unit trusts for wealth management/advisory practices such as ours. Full disclosure: I paid for my own trip so no conflicts there.

At the conference, we attended sessions that dealt with topics such as:

- Alternative Investments’ Place in Client Portfolios

- Digital Assets Are More Than Bits and Bytes

- Software Has Eaten the World. What’s Next?

- Reality May Evolve Into The Metaverse, but Should Investors Care?

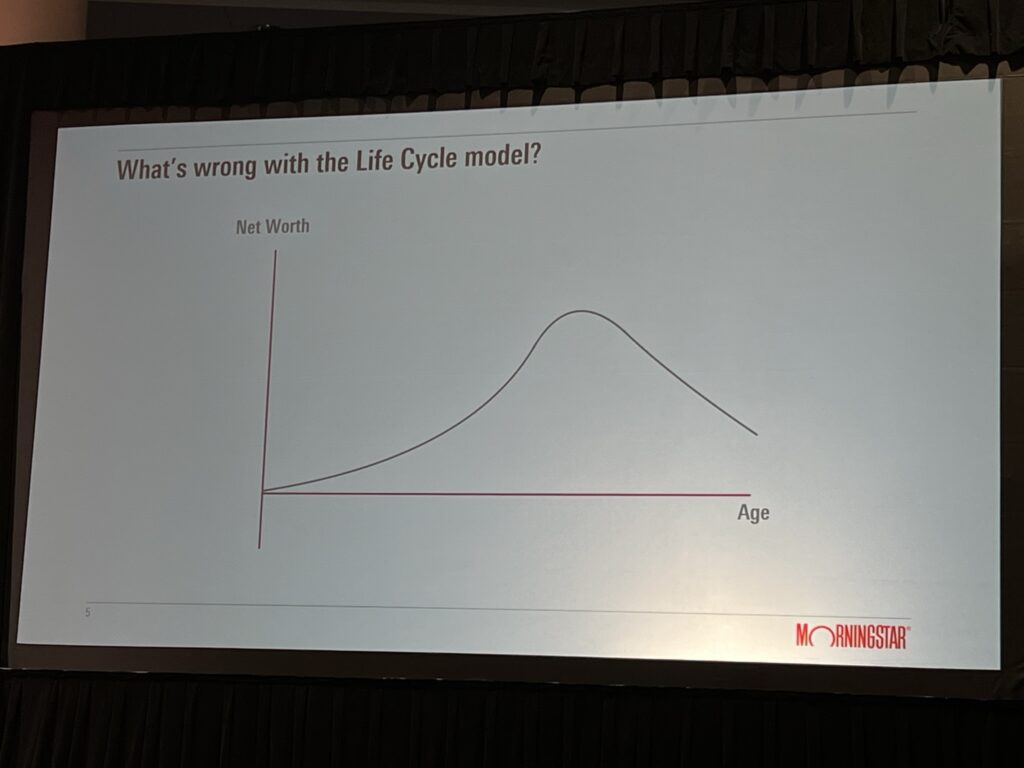

- The Real Financial Planning Life Cycle

- Where in the World Are Equity Opportunities?

- Risks and Opportunities in Emerging Markets

I really enjoyed the trip as I had a chance to hear what our peers are thinking about and how their businesses are evolving as time passes. New York is super busy, accommodation small, expensive but also very impressive and has a lot to offer. Chicago was truly beautiful as the City is built around the Chicago river with breathtaking architecture. In October 1871, a fire destroyed one-third of Chicago and left more than 100,000 homeless. The factories and railroads were largely spared, and the city was rebuilt with astonishing speed. In 1885 Chicago gave the world its first skyscraper, the 10-story Home Insurance Building.

America was great but there’s still no place like home.