by Martin de Bruyn, CFA, CFP®

It has become increasingly easier to invest money abroad over the years. This is still Treasury’s intention but there are no guarantees offered for the future. South African citizens over the age of 18 are currently allowed to take R1m p.a. offshore without any approval plus an additional R10m per person p.a. by obtaining a tax clearance certificate from SARS.

Once you have decided whether you would like to invest in the financial markets or to buy a Portuguese/Mauritian property etc., it is important which vehicle that asset is held through as this will affect the amount of taxes that will be payable upon death and will affect how easy/difficult or costly it is to administer your estate. It is important to bear in mind that the process, taxes and costs will have a direct impact on your loved ones and therefore it is important that a solid estate plan is in place.

It is crucially important to understand whether the asset you own is situated in a country whose law system is based on Common Law or Civil Law as this will possibly impact your succession plan. Civil Law countries do not allow for freedom of testation as is the case in Common Law countries like the UK and SA. See below for a few other differences as it relates to estate planning:

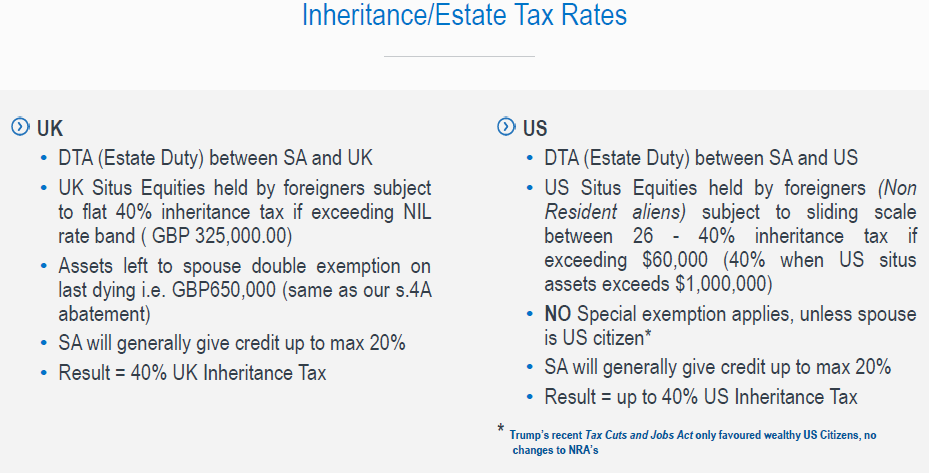

An important though not so well-known offshore tax has reared its ugly head in the last few years which is normally referred to as Situs Tax. Situs is Latin for situated, which refers to where your asset is situated. US assets held by foreigners are subject to Estate Tax at up to 40% above $60,000 and UK assets are subject to Inheritance Tax at 40% above £325,000. Your estate may therefore pay more than the rate of 20-25% applicable on South African estates.

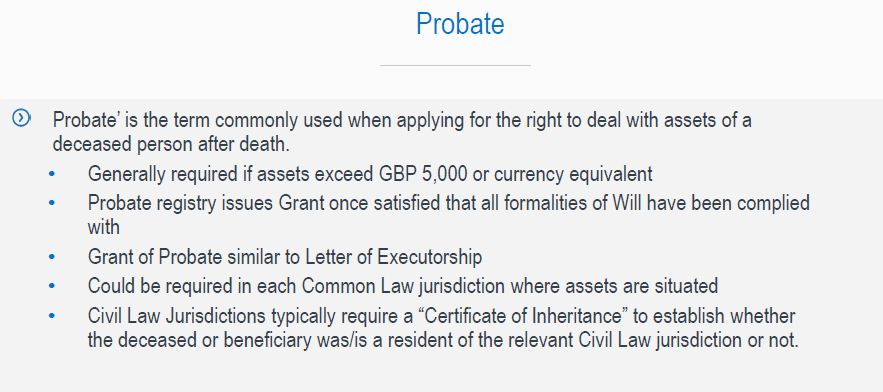

In order to simplify the administration of your offshore estate, many practitioners advise to have a local and offshore will, especially where assets are held in non-English speaking countries like France or Portugal where a different language and specific terms are used as part of their deceased estate administration process. This process can be very tedious, time-consuming and costly. Another way to simplify or even get around the offshore deceased estate administration process (“Probate”) is to use an offshore structure like a life wrapper, trust and/or company structure.

If you have any questions regarding your worldwide investment structuring, please reach out to us.

Sources:

- Presentation, Anton Moskowitz, SPW Fiduciary & Tax, 26 July 2019